Ethereum’s price has been on a tear in 2025, recently hitting around $4,600 – its highest level since December 2021. This dramatic surge has put the spotlight back on the world’s second-largest cryptocurrency and raised a pressing question: Is Ethereum now leading a new altcoin season? Crypto traders and analysts are abuzz with optimism as institutional inflows pour into Ether funds and retail activity picks up, yet uncertainty lingers over whether a true altcoin boom is underway or if this is simply an “Ethereum season” – a rally largely centered on ETH itself. In this explainer, we’ll delve into the evidence and context behind Ethereum’s recent outperformance, examine how it fits into the broader crypto market cycle, and explore what it could mean for other altcoins and Ethereum’s Layer-2 ecosystem.

The term “altcoin season” refers to periods when alternative cryptocurrencies (basically every crypto asset other than Bitcoin) see massive gains and outperform Bitcoin over a sustained stretch. These phases are typically characterized by capital rotating out of Bitcoin into higher-risk coins, rapid run-ups in prices across the board, and a frenzied market sentiment among investors chasing the next big win. Historically, altcoin seasons have followed major Bitcoin rallies, once the Bitcoin price stabilizes and traders seek bigger returns elsewhere.

Today, with Bitcoin reaching new all-time highs above $100,000 and then cooling off, conditions seem ripe for altcoins to shine. Ethereum, the largest altcoin, is showing strong bullish signals – from record on-chain activity to unprecedented institutional interest – that suggest it could be the prime driver of the next altcoin surge. But is the broader altcoin market truly shifting into high gear, or are we witnessing a more Ethereum-centric phenomenon? And importantly, if an Ethereum-led rally does unfold, what ripple effects will it have on the rest of the crypto ecosystem, especially the fast-growing Layer-2 networks built atop Ethereum?

In this article we'll focus on the current state of play in 2025 while also drawing lessons from past market cycles. We’ll break down the key factors fueling Ethereum’s rise (such as exchange-traded fund inflows and corporate adoption), the health of Ethereum’s network, and the evolving narrative that pitches ETH as the “backbone” of decentralized finance. We’ll also examine early signs of an altcoin season: Bitcoin’s dominance in total market value has begun to slip, and some older altcoins are suddenly springing to life – classic signals of rotation. At the same time, caution is warranted. We’ll discuss potential risks – including warnings from Ethereum’s own founder Vitalik Buterin about overleveraged institutional bets – and the possibility that the current euphoria could face pullbacks. Finally, with Ethereum’s success increasingly tied to Layer-2 scaling solutions, we’ll explore what an “Ethereum season” means for Layer-2 networks like Arbitrum, Optimism, and Base, which are handling an ever-growing share of transactions.

Ethereum’s 2025 Resurgence: Back to All-Time High Territory

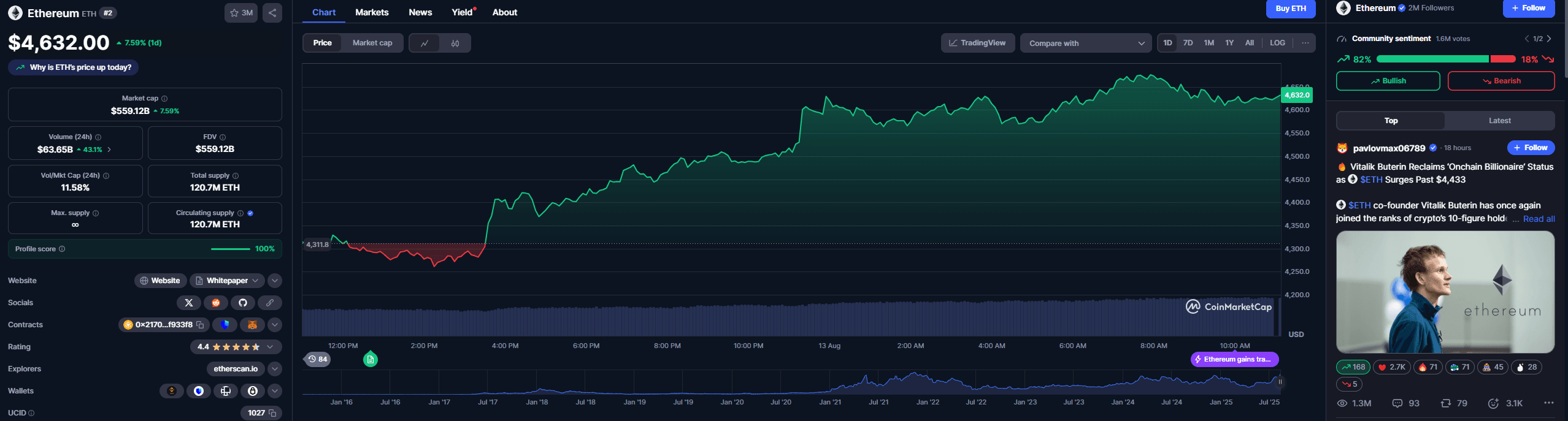

After a grueling bear market in 2022–2023, Ethereum has staged an impressive comeback over the past year. In early August 2025, Ether broke above the $4,000 level for the first time in nearly four years, then swiftly powered past $4,200 and $4,500 in a matter of days. By mid-August, ETH briefly touched approximately $4,600, putting it within a few percentage points of its all-time high around $4,800 set in November 2021. For context, Ethereum had fallen to lows near $1,000 during the last bear market, so this rally marks a more than fourfold increase from those bottom levels. The strong upward momentum has been punctuated by bursts of short-covering: as prices climbed, traders betting against ETH were forced to liquidate positions, further accelerating the rise. In one 48-hour span, over $200 million in ETH short positions were wiped out on exchanges, adding fuel to Ethereum’s surge. “ETH bears are getting slaughtered,” one analyst quipped as the rapid price moves caught many pessimistic traders off guard. This cascading effect of liquidations not only underscores the strength of the rally but also hints at shifting market sentiment in favor of Ethereum.

Several quantitative indicators reflect Ethereum’s return to bull-market form. Trading volumes have swelled alongside price: on August 8, when ETH first breached $4,000, trading activity on major exchanges nearly tripled the daily average. Such high volumes signal robust interest from both retail and institutional players as Ethereum regains lost ground. Moreover, on-chain data shows unprecedented usage of the Ethereum network, reinforcing the notion that this rally is underpinned by genuine demand rather than pure speculation. In July 2025, the Ethereum blockchain recorded 46.67 million transactions for the month – the highest monthly count in its history. Put differently, Ethereum’s transaction activity has never been higher than it is now, even compared to the feverish peak of late 2021. In dollar terms, Ethereum’s on-chain transaction volume hit a record $238 billion in July 2025, a 70% surge from the previous month. Whether it’s users trading on decentralized exchanges, moving stablecoins, or interacting with smart contracts, the sheer value being settled on Ethereum is staggering and reflective of a thriving ecosystem.

Crucially, this explosion in activity has not (yet) choked the network with unsustainable fees as occurred in past bull runs. Average transaction fees on Ethereum remained in the modest $0 to $4 range through July and early August, with only brief spurts to $6–$8 during peak congestion. By comparison, during the 2021 bull market it was not uncommon to see double- or triple-digit dollar fees for a single Ethereum transaction at times of heavy demand. The current relatively low fees suggest that Ethereum’s scalability enhancements and Layer-2 usage are mitigating congestion (more on that in later sections). In fact, Ethereum’s blocks are only about half full on average (around 50% gas utilization), indicating spare capacity thanks to protocol upgrades and off-chain scaling solutions. This is a positive sign that the network can handle additional growth without immediately pricing out users with high costs.

Another metric reflecting confidence in Ethereum’s future is the amount of ETH being locked up rather than traded. Since Ethereum’s successful shift to a proof-of-stake consensus (the Merge in 2022), more and more holders have been staking their Ether to secure the network and earn yield. As of August 2025, over 30% of the total ETH supply is now staked in the network’s deposit contracts. That’s a huge increase in just a couple of years, and it exceeds 120 million ETH valued at more than $150 billion at current prices. Staking effectively takes those coins out of liquid circulation (at least for some period), contributing to a supply squeeze that can enhance price appreciation. Echoing this, the amount of Ether sitting on exchanges – available for sale – has plummeted. Exchange-held ETH has dropped to 15.3 million ETH, the lowest level since 2016. In other words, one of every eight Ether in existence is now locked in staking, and the portion held in exchange hot wallets is at a nine-year low. This combination implies many investors are holding for the long term, either earning staking rewards or at least not looking to cash out on exchanges. Such dynamics reduce sell pressure and can create a tighter market supply, which in turn supports price gains. An analyst at Cointelegraph noted that these trends – rising on-chain activity, low exchange supply, and high staking participation – are bullish indicators for ETH.

The market’s positive feedback loop around Ethereum is evident. As ETH’s price has climbed, it has created what some call an “on-chain wealth effect” – investors see their portfolio values swell and often rotate some profits into other tokens, spreading the rally to the wider altcoin market. We are starting to witness this rotation (for example, mid-cap tokens like Litecoin, Solana, and Chainlink have recorded double-digit gains alongside Ethereum). But before examining the altcoin landscape, it’s important to understand why Ethereum is surging now. The rally hasn’t occurred in a vacuum; several fundamental drivers and a shifting macro backdrop have played a role. In the next section, we’ll break down the key factors – from ETF inflows to a narrative pivot among big investors – that have coalesced to make Ethereum arguably 2025’s hottest major crypto asset.

What’s Driving Ethereum’s Surge? Institutional Inflows, New Narratives, and More

Multiple converging factors are propelling Ethereum upward in 2025, painting a picture of growing mainstream acceptance and utility. First and foremost is the remarkable wave of institutional investment interest centered on Ethereum lately. In August 2025, U.S.-listed Ether exchange-traded funds (ETFs) saw record-shattering inflows, indicating that big money is eagerly positioning in ETH. On a single day – August 11, 2025 – net inflows into Ether ETFs topped $1.01 billion, the largest one-day haul ever. To put that in perspective, these Ether fund inflows were five times larger than what Bitcoin funds attracted that day; Bitcoin ETFs saw a comparatively modest $178 million of net inflows. BlackRock’s iShares Ethereum Trust led the charge, absorbing about $640 million of that capital in one day, while Fidelity’s Ethereum fund pulled in another $277 million. Cumulatively, U.S. Ether ETFs now hold over $25 billion in assets – roughly 4.8% of Ethereum’s market cap – after only launching less than a year ago. Such explosive interest from institutions in an Ethereum investment vehicle would have been unthinkable a few years ago, when Bitcoin was the only crypto considered palatable for Wall Street.

This sudden institutional pivot toward Ethereum has been driven by a changing narrative. For years, Bitcoin was king in the eyes of traditional finance, lauded as “digital gold” – a simple, compelling analogy that helped institutions get comfortable with BTC as a store of value. Altcoins, by contrast, were often viewed with skepticism. But Ethereum has increasingly differentiated itself with a coherent value proposition that big investors are starting to appreciate. If Bitcoin is digital gold, Ethereum is being touted as “the backbone of future financial markets,” thanks to its role in decentralized finance (DeFi), smart contracts, and tokenized assets. This phrasing comes straight from Bloomberg ETF analyst Nate Geraci, who observed that many in traditional finance previously underestimated Ether simply because they didn’t understand it, but that is now changing. Ethereum’s blockchain is where a huge chunk of crypto economic activity happens – from lending and borrowing to trading and issuing new tokens – so owning ETH is increasingly seen as owning a crucial piece of the infrastructure for the “digital economy”. In essence, ETH produces yield (via staking), powers transactions in a vibrant network of dApps, and even burns fees (reducing supply) with each transaction. These features make it more akin to a productive asset or a form of “digital oil” that fuels Web3 platforms, rather than just a speculative token. Such narratives have given traditional investors a new bullish thesis for Ethereum on top of Bitcoin’s store-of-value appeal.

The data backs up this narrative shift. Consider the trend of corporate treasury adoption of Ether. A few years ago, a handful of companies (like MicroStrategy or Tesla) made headlines for holding Bitcoin in their treasuries. Now, we are seeing companies begin to hold Ethereum as a strategic asset. By August 2025, public companies and fund treasuries collectively hold over $11 billion worth of ETH on their balance sheets. This figure swelled from around $9 billion to $13 billion just in the recent rally, as the price increase boosted the value of their holdings. More firms are embracing ETH “not just as a speculative play, but as a strategic financial tool,” explains Jamie Elkaleh, an executive at Bitget Wallet. Companies see that by holding and staking Ethereum, they can earn passive yield (currently staking yields are on the order of ~5% annually) while also participating in the burgeoning DeFi economy. This is a stark contrast to holding, say, cash (which yields little) or even Bitcoin (which has no native yield unless lent out). In Elkaleh’s words, Ethereum’s appeal to corporates lies in its “foundational utility” – treasuries can put ETH to work and simultaneously help secure the network by staking. It’s a mutually reinforcing dynamic, and one that further cements Ethereum’s image as the “digital oil” lubricating the gears of new financial infrastructure.

Another tailwind for Ethereum has been the evolving regulatory and macroeconomic environment in 2025, which has generally been more favorable to crypto than the storms of previous years. In the U.S., a major overhang was resolved when the Securities and Exchange Commission (SEC) effectively ended its lawsuit against Ripple (XRP) in mid-2025 and conceded ground on what constitutes a security in crypto. The conclusion of that high-profile case was interpreted as a broader green light for altcoins, Ethereum included, since Ether had also faced past questions about its regulatory status. In addition, U.S. regulators provided clarity that certain staking services and liquid staking tokens are not securities, easing fears that Ethereum’s move to proof-of-stake could invite regulatory crackdowns. This “regulatory clarity” around Ethereum’s core activities has boosted confidence among institutions and retail participants alike. Globally, countries like Canada and several in Europe already have Ethereum ETF products and friendly stances, adding to the legitimacy of ETH as an investable asset.

The macro backdrop cannot be ignored either. After a period of rising interest rates in 2022–23 that hurt risk assets, the pendulum is swinging back. By mid-2025, there is a strong expectation that the U.S. Federal Reserve will begin cutting interest rates, potentially as soon as the fall. Futures markets put the probability of a September 2025 rate cut at over 80%. This prospect of easier monetary policy has been a boon for equities and crypto alike, as lower rates typically drive investors toward higher-yielding or growth-oriented assets (since bonds and cash become less attractive). Ethereum, with its combination of growth narrative and yield from staking, stands to benefit in a “lower for longer” rate environment. Indeed, news of softening inflation and imminent rate cuts coincided with Ether’s push past $4,300 in August. Simultaneously, geopolitical and policy developments such as the U.S. Congress advancing pro-crypto legislation (e.g., a bill to regulate stablecoins, known as the GENIUS Act) have improved sentiment. Sean Dawson, head of research at Derive, noted that “favorable U.S. government policy and well-timed institutional engagement has resulted in blood rushing back into the crypto market.” All these forces – macro tailwinds, regulatory clarity, and institutional narrative shifts – have aligned to create a kind of perfect storm for Ethereum specifically.

On the retail side, Ethereum is also seeing renewed interest, albeit in a more measured way than the meme-fueled crazes of the past. There has been a steady uptick in the number of active Ethereum addresses (over 680,000 daily actives recently, a multi-year high), suggesting new and returning users are engaging with the network. Retail crypto investors are also increasingly aware of Ethereum’s central role in DeFi and NFTs, and many view owning ETH as a gateway to participate in those ecosystems. The psychological element is key: as Ethereum approaches their previous all-time high, retail traders have grown more bullish in online chatter – terms like “buying” and “bullish” started vastly outnumbering “selling” and “bearish” in social media posts once ETH crossed $4k. This uptick in retail optimism can itself become a self-fulfilling driver in the short term (through FOMO buying), though it’s something to watch cautiously as excessive euphoria can herald corrections. Market intelligence firm Santiment pointed out that the surge in bullish sentiment in early August was notable and cautioned that overconfidence sometimes leads to short-lived pauses even during uptrends.

In summary, Ethereum’s surge is underpinned by strong fundamentals and shifting perceptions. Big investors are buying in via record-breaking ETF flows, embracing Ethereum as a core holding alongside Bitcoin. Companies are putting ETH on their balance sheets and staking it, adding a long-term demand base. The network itself is smashing usage records in transactions and volume, reflecting real adoption. And external conditions – from Fed policy to regulatory wins – have created a more hospitable climate for a rally. All of these set the stage for Ethereum to potentially lead the crypto market’s next phase. But does this translate into a full-blown altcoin season? To answer that, we need to step back and examine how an “altcoin season” is defined, and whether the current market structure supports the idea that we’re entering one.

Altcoin Season 101: Understanding the Cycle and Historical Parallels

“Altcoin season” (or “altseason”) is a slang term, but it describes a very real market phenomenon. By definition, an altcoin season is a period when alternative cryptocurrencies broadly outperform Bitcoin for an extended period (usually measured in weeks or a few months). During these phases, a majority of altcoins see significant price increases, often achieving multiples of their previous value, while Bitcoin either trades sideways or grows at a slower pace. In practical terms, if you see your crypto portfolio’s smaller coins shooting up much faster than BTC, you’re likely in an altcoin season. These periods tend to be marked by high volatility and frenetic trading activity across the crypto spectrum. New projects can skyrocket overnight, and even older, long-forgotten coins can suddenly come back to life as traders hunt for the next big gainer. Crucially, altcoin seasons are usually short-lived climactic moments of a bull market – they often occur near the later stages of an overall crypto uptrend and can cool off quickly once the speculative excesses burn out.

Historically, altcoin seasons have coincided with declining Bitcoin dominance. Bitcoin dominance is the share of Bitcoin’s market capitalization relative to the total crypto market cap. When Bitcoin dominance falls sharply, it means altcoins (collectively) are growing in value faster than Bitcoin. We have two prime historical examples to consider: the altcoin booms of late 2017/early 2018 and of spring 2021.

-

2017–2018 Altcoin Season: Bitcoin had a massive rally in late 2017, peaking just below $20,000 in December of that year. At its height, Bitcoin commanded about 85% of the entire crypto market’s value. But as 2018 began, Bitcoin’s dominance plunged – from 86% in late 2017 to roughly 38% by January 2018. This collapse in dominance was because hundreds of altcoins were exploding in price, even as Bitcoin itself actually started to pull back from its highs. The trigger was a mania for Initial Coin Offerings (ICOs) – essentially crowdfunding sales for new tokens – that led to a flood of money into Ethereum (which was used to buy ICO tokens) and into the new tokens themselves. Ethereum’s price in that period shot up to about $1,400 (from under $10 a year prior), and many smaller altcoins like Ripple (XRP), Cardano, and others saw exponential gains. For a brief time, it seemed like every coin was a moonshot, and Bitcoin became almost “boring” by comparison. That altseason ended abruptly in early 2018 when regulatory fears around ICOs and general market exhaustion caused a sharp downturn – many altcoins lost the majority of their value in the subsequent bear market.

-

2021 Altcoin Season: Fast forward to 2020–2021, the crypto market experienced another major bull run. Bitcoin once again led the early charge, reaching then-record highs (~$64k in April 2021). But after that initial Bitcoin surge, attention shifted to altcoins through the spring. By May 2021, Bitcoin’s dominance slid from about 70% at the start of 2021 to roughly 40% by mid-year. During this period, meme coins like Dogecoin and Shiba Inu achieved jaw-dropping growth (Dogecoin infamously gained over 10,000% in a few months, turbocharged by social media and celebrity buzz). At the same time, sectors like NFTs (non-fungible tokens) boomed on Ethereum and other chains, lifting coins associated with NFT platforms and gaming. This was a more diversified altseason – not just one trend like ICOs, but many (meme coins, DeFi tokens, NFT-related tokens, smart contract platform tokens) all accelerating. By April 16, 2021, a popular “Altcoin Season Index” hit a reading of 98 out of 100 – an extreme indication that altcoins had far outperformed Bitcoin over a 90-day window. Put simply, if you held almost any of the top 50 altcoins in early 2021, you likely outperformed holding Bitcoin alone during that stretch. As with 2018, this altcoin frenzy eventually cooled; Bitcoin had a second rally to a new high in late 2021, and many alts took turns peaking and then falling back as the cycle entered 2022.

From these episodes, a pattern emerges: Altcoin seasons tend to follow a big run-up in Bitcoin, once Bitcoin’s price growth starts to plateau. Investors with large BTC profits rotate some of that capital into altcoins, which are seen as having higher short-term upside. This rotation is often described as “BTC gains -> ETH pumps -> then mid- to low-cap alts pump.” It starts with Ethereum typically (being the largest and most liquid altcoin), and then spills over into progressively smaller and riskier coins. A key prerequisite is that Bitcoin at least stabilizes; if Bitcoin is crashing, altcoins usually crash even harder, preventing an altseason. But if Bitcoin is strong or range-bound, it creates a confidence and opportunity for traders to venture into alts.

Given this understanding, how does the current moment stack up? In 2025, Bitcoin saw an enormous rally in the first half of the year, smashing through its previous $69k high and reaching levels around $100k to $120k by mid-year. In fact, Bitcoin hit a new all-time high (reports indicate it topped $119,000 on some exchanges) in July 2025. After such a historic surge, Bitcoin’s momentum has cooled a bit; it has been trading near the $110k–$120k range recently rather than accelerating nonstop. True to form, we started seeing capital shift toward Ethereum and certain altcoins as Bitcoin took a breather. Bitcoin’s dominance, which was over 60% for the first time in years during its peak run, has begun to fall. At the start of July, BTC dominance was around 64%. By early August 2025, it had declined to roughly 59% of total crypto market cap. That may not sound huge, but in a market worth trillions, a 5-point drop in dominance represents many tens of billions of dollars flowing into altcoins instead of Bitcoin. Market watchers absolutely take note when BTC dominance breaks trend. In fact, technical analysts pointed out that Bitcoin dominance breaking below a multi-year uptrend line in mid-2025 could be a strong signal that a major altcoin cycle is commencing.

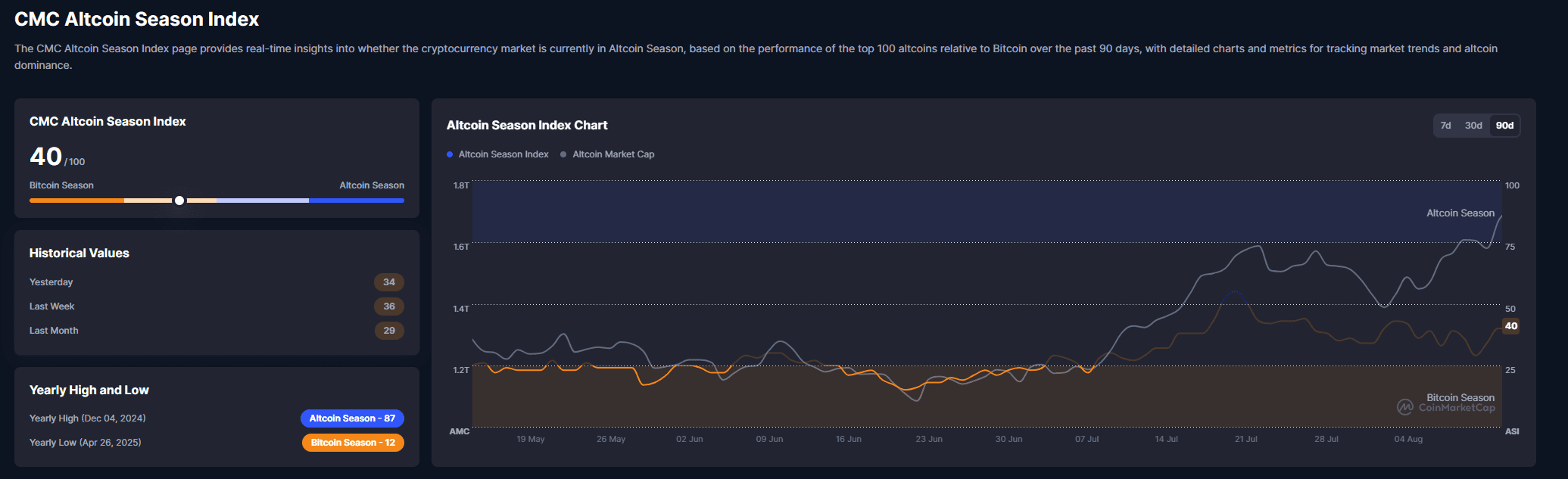

Additionally, Ethereum’s performance relative to Bitcoin in recent weeks has been striking. Over a one-month span (late June to early August), ETH gained about 54% in value whereas Bitcoin rose roughly 10%. Such stark outperformance by Ethereum is typically one of the early hallmarks of an altcoin season. The Altcoin Season Index maintained by BlockchainCenter was creeping upward through this period – it rose from a very low “Bitcoin season” reading into the 30s and 40s (out of 100), indicating the market was tilting towards altcoins but not yet in full altseason mode as of early August. By mid-August, this index reading is around the low 50s (on the fence), reflecting that about half of top coins have outpaced Bitcoin over the last 90 days. Meanwhile, a shorter-term Altcoin Month Index showed an emphatic “It’s Altcoin Month!” signal (score above 75) for the 30-day period. In plain terms, momentum has clearly shifted to altcoins in the last month, even if the longer-term picture hasn’t fully flipped.

We’re also witnessing classic qualitative signs of an altseason’s dawn. One sign is dormant or “old-school” altcoins suddenly rallying in tandem, which often indicates that liquidity from Bitcoin is spilling over widely. This happened in mid-July 2025: as soon as Bitcoin notched its new high and stalled, a bunch of veteran altcoins had big pumps. XRP (Ripple), which had been under a cloud due to its SEC lawsuit for years, finally resolved much of its legal uncertainty and promptly skyrocketed to a new all-time high of around $3.65 – its first record peak in seven years. In XRP’s wake, other “OG” cryptos like Ethereum Classic (ETC), Litecoin (LTC), and Bitcoin Cash (BCH) suddenly saw double-digit daily gains in July. These are older, well-known coins that often don’t move much until something big shifts in market dynamics. Their sudden revival was noted by experts as a possible “early sign that a broader altcoin season might be on its way.” Akshat Vaidya, CIO of venture firm Maelstrom, told Decrypt in July that “old-school tokens pumping is an early sign” of an alt rally, though he cautioned that we may have to wait for a “true altseason” to see newer and smaller tokens join the party. Vaidya observed that Bitcoin’s dominance was “starting to dip” from its highs, and a “rotation into altcoins such as Ethereum clearly shows that momentum is building.” In his view, this mirrors historical patterns: after Bitcoin hits an all-time high, the following months often deliver an altcoin boom – essentially, history repeating itself in crypto cycles.

This testimony aligns with what we are seeing: Ethereum leading the pack, then the bigger altcoins like XRP, LTC, etc., and potentially the rest of the altcoin market later. It’s worth noting that not all altcoins have surged just yet. Many smaller-cap or newer project tokens remained relatively quiet through July while the focus was on Ethereum and a handful of majors. Some analysts interpret this as the altcoin cycle being in an early phase, not a full frenzy. “It’s not fully underway yet,” as Vaidya said. Typically, the more speculative coins (think small DeFi tokens, newer Layer-1s, meme coins, etc.) might rally in the later stages of an altseason, once the large-caps have had their run and traders rotate further out on the risk curve. We may be heading in that direction should favorable conditions persist.

In summary, current market indicators and expert observations suggest that an altcoin season could be emerging, led by Ethereum’s breakout. Bitcoin’s dominance has cracked downward from recent highs – it’s hovering in the high-50s percent, a zone historically associated with altcoin strength. Ethereum has clearly outperformed Bitcoin in the recent timeframe, and we’re seeing capital rotation take hold. As one crypto writer put it on August 13, “what we’re seeing now isn’t an ‘altseason,’ it’s an Ethereum season.” That brings us to an interesting nuance: the idea that we might currently be in an “Ethereum season” specifically. Let’s explore what that means and how it differs from a broad altcoin season.

Ethereum Season vs. Altcoin Season: Is Ether in a Class of Its Own?

The phrase “Ethereum season” has been coined by market analysts to describe a scenario where Ethereum is outperforming not just Bitcoin, but also outpacing most other altcoins – effectively making it the chief beneficiary of capital rotation. In an Ethereum season, the market’s attention and gains concentrate in ETH, whereas smaller altcoins (excluding Ethereum) might lag behind or only rise moderately. This concept gained traction in mid-2025 as observers noticed that while Ethereum was soaring, many altcoins were actually losing value relative to ETH. Crypto analyst Benjamin Cowen highlighted this trend: since April 2025, the basket of altcoins excluding BTC and ETH had dropped roughly 50% when measured against Ethereum. In other words, if you held an index of altcoins other than Ether, those assets on average lost half their value in ETH terms over a few months – a brutal underperformance. Cowen’s takeaway: this is not broad altseason yet; it’s Ethereum’s show for now. “Altcoins will have their time – but the market’s eyes are on ETH breaking $5K first,” a report from CaptainAltcoin summarized, reflecting Cowen’s view. As long as Ethereum’s dominance (its share of total altcoin market cap) is rising, we are effectively in an Ethereum-led phase.

Indeed, Ethereum has been climbing the rankings in terms of market cap and influence. ETH now accounts for roughly 20% of the total crypto market by itself (with Bitcoin around 55–60%). Ethereum’s market capitalization is larger than the sum of the next several largest altcoins combined. So, one could argue that Ethereum is less an “altcoin” these days and more a primary pillar of the market, alongside Bitcoin. Some traders even treat ETH as its own category. Online, the meme “not altseason, it’s #EthereumSeason” has circulated as ETH/BTC ratio ticks up. That ratio – which measures how many BTC one ETH is worth – is a key barometer. It has been rising off its lows, indicating Ethereum gaining on Bitcoin. As of August, ETH is around 0.038 BTC (3.8% of a Bitcoin). While that’s still below the peaks (Ethereum was ~8% of Bitcoin’s value at times in 2017 and 2021), the ratio has improved in Ethereum’s favor in recent weeks, reversing a prior trend of BTC outperformance earlier in the year.

One consequence of an Ethereum-centric rally is that investor capital tends to flow into Ethereum-related projects more than into external alt themes. We’re seeing that play out: tokens and projects directly tied to Ethereum’s ecosystem (like Layer-2 network tokens, decentralized exchange tokens, liquid staking derivatives, etc.) have garnered interest. For example, the native tokens of Layer-2 networks Arbitrum (ARB) and Optimism (OP) have bounced from their bear-market lows as Ethereum usage grows, though so far their price gains have been modest compared to ETH’s run. Another example is Coinbase’s new Layer-2, Base, which doesn’t have a token but has attracted a flood of capital into applications built on it (like the recent social app Friend.tech that went viral). Base’s total value locked (TVL) reportedly rocketed by 9,000% in a matter of weeks, reaching about $4.5 billion, as users rushed to deploy assets on this Ethereum-aligned network. Such staggering growth underscores that much of the excitement is concentrated within the Ethereum universe – the “Ethereum-led ecosystem,” as one report calls it.

During this Ethereum season, smaller altcoins measured against ETH have struggled. Cowen notes that many alt/ETH pairs have been bleeding, meaning if you held alt X instead of ETH, you’d have less ETH now than a few months ago. This dynamic could persist until Ethereum decisively breaks its all-time high and perhaps exhausts some of its momentum. Historically, what often happens is: Ethereum leads the initial phase of the alt rally, sometimes even nearly keeping pace with Bitcoin’s gains, and then once Ethereum itself hits a plateau (for instance, if ETH reaches a big psychological price like $5,000 and then consolidates), the next phase begins where capital rotates to smaller alts en masse. A similar pattern was observed in previous cycles: Ethereum would pump hard, then when it cooled, the truly manic altseason kicked off (with things like the DeFi summer in 2020 or the meme coin craze in 2021). We could be heading for a repeat. As Cowen mentioned, traders should watch the ETH/BTC trend – “as long as ETH/BTC keeps climbing, altcoins measured against BTC will likely rise too. However, ALT/ETH pairs will continue to bleed for another week or two before we get any meaningful relief bounce.” In other words, first ETH outperforms everything (Ethereum season), then eventually the smaller alts start outperforming ETH in the later stage of a full altcoin season.

Some market analysts have even sketched out a potential roadmap for this rotation. Crypto commentator Miles Deutscher described a three-stage cycle that could play out over months: Stage 1: An ETH-led mini altcoin season (we’re arguably in this now) where Ether rallies strongly and large-cap alts perk up. Stage 2: A rotation back into Bitcoin – he speculates that at some point Bitcoin may regain dominance and make another push (possibly toward $120k–$140k) while many altcoins lag behind. Stage 3: Finally, a “blow-off” altcoin rally where capital floods back into Ethereum and then into smaller tokens, marking the cycle’s speculative peak. Under this scenario, the true broad altseason might still be ahead, after a potential interim Bitcoin run. Whether or not things unfold exactly in that sequence, the key takeaway is that Ethereum’s strength is a necessary ingredient for a broader altcoin season, but it might not immediately translate into across-the-board altcoin gains until a bit later. For now, Ethereum is in the driver’s seat.

It’s also worth considering how sentiment and risk appetite differ in an Ethereum-led phase versus a typical alt free-for-all. When Ethereum is the focus, it suggests the market mood is bullish but still somewhat measured – investors are putting money into what is arguably a “safer” big-cap crypto with fundamental support. Ethereum has institutional buyers, real usage, and comparatively lower risk than tiny altcoins. An “Ethereum season” implies confidence in crypto’s medium-term outlook, but not blind speculation on every token. Once we transition to a full altseason, usually the psychology shifts to a more euphoric, risk-blind chase of any coin that’s moving (we saw that with dog-themed coins in 2021, etc.). There are early signs of increasing speculative appetite – for example, mentions of obscure altcoin tickers popping up more on forums, and some relatively new projects (like Sui or Sei, which are new layer-1 chains) popping 20-30% in a day. But overall, the market in August 2025 still seems to be placing its biggest bets on Ethereum and a handful of top players. As one trader on X (Twitter) put it, “We’re seeing early signals of an altcoin season... It could very well be that history repeats, with a post-BTC all-time high altseason. But you’ll have to wait for a true altseason to see newer coins pump”.

For the average crypto participant, the implications are clear: Ethereum is currently providing leadership and relative stability, and many are eyeing ETH’s milestones (like the all-time high near $4.8k, and the big $5,000 level) as the next pivotal moments. If Ethereum decisively breaks into price discovery above its old peak, it could trigger a wave of FOMO (fear of missing out) and a shift into “full risk-on mode” across crypto. Until then, it remains “Ethereum season.” As Petar Jovanović wrote on August 13, the market’s eyes are on ETH hitting $5K, and “for now, this is still very much Ethereum season. Altcoins will have their time – but [first] the market’s eyes are on ETH...”.

Speaking of Ethereum-centric growth, one area tightly interwoven with Ethereum’s success is the Layer-2 scaling sector. Ethereum’s rally and heavy usage directly impact Layer-2 networks that help carry its load. Let’s examine how an Ethereum-led altcoin season (or “Ethereum season”) might play out for those Layer-2 solutions and what changes we’re seeing in network usage patterns.

Layer-2 Networks in an Ethereum Boom: Scaling Up for the “Season”

One of the most significant developments since the last crypto cycle is the rise of Ethereum Layer-2 networks – secondary blockchains or rollups that extend Ethereum’s capacity by processing transactions off the main chain (Layer 1) and then settling results back to it. In 2021, high traffic on Ethereum meant sky-high fees and a poor experience for many users. By contrast, here in 2025, Ethereum’s bull run is occurring in tandem with unprecedented Layer-2 adoption, fundamentally changing how a new altcoin season could unfold. In short, if “Ethereum season” comes true and usage explodes, Layer-2 networks are poised to absorb much of that activity, keeping the system more scalable and efficient than in past booms.

The numbers are revealing: as of mid-2025, it’s estimated that over 85% of all Ethereum ecosystem transactions now occur on Layer-2s rather than the Layer-1 chain. In other words, the vast majority of individual user transactions (like token swaps, NFT trades, game interactions, etc.) are happening on networks like Arbitrum, Optimism, Base, zkSync, and others that piggyback on Ethereum’s security. Meanwhile, Ethereum L1 continues to do what it does best – act as the settlement and security layer for big value transfers. It still processes about 85% of all the value moved (since large transfers, whales moving funds, and final settlements often occur on L1). Ethereum L1 also holds the lion’s share of assets: around 90% of all stablecoin value and over 80% of tokenized real-world assets in crypto are on Ethereum mainnet. So Ethereum is evolving into a two-tier system: Layer-1 as the high-value backbone, and Layer-2 as the high-volume workhorse for everyday transactions.

This shift has been supercharged by recent technical upgrades. In late 2024, Ethereum implemented the “Dencun” hard fork (which includes the EIP-4844 upgrade, also nicknamed Proto-Danksharding). Dencun introduced so-called “blobs” of data that Layer-2 rollups can use to post transactions to Ethereum at very low cost. The result was a drastic reduction in the cost for L2s to write data to L1 – essentially cutting their operating costs by an order of magnitude. One report noted that after Dencun, data settlement costs became “near-zero” for L2s, allowing some like Coinbase’s Base network to operate with over 98% profit margins on its transaction fees. With such low costs, L2s can keep user fees extremely cheap (often just pennies per transaction) and still be sustainable businesses. This has made Layer-2s far more attractive to users, driving a virtuous cycle of adoption. For example, on decentralized exchanges (DEXs), the number of trades on L2 more than doubled year-over-year by May 2025, and that month Base even surpassed Ethereum L1 in total DEX trading volume – a remarkable milestone. It shows that users, when given the option, will happily trade on a faster, cheaper L2 venue while relying on Ethereum’s security assurances in the background.

So, if Ethereum usage surges further in an altcoin season, Layer-2 networks are ready to carry the extra load. We’re already seeing them step up. Base, the newcomer L2 incubated by Coinbase, has made headlines with its explosive growth. Within just a few months of launch, Base reportedly saw a 9,000% increase in total value locked, reaching about $4.5B TVL, thanks in part to popular new dApps launching there. Base has also become the dominant L2 by some measures: by May 2025 it was accounting for over 80% of all L2 transaction fees and generating nearly $6 million in monthly revenue (suggesting very high usage). Some of that activity is driven by hype cycles (like Base’s ecosystem had a frenzy of meme coin trading and a new social app), but importantly, it demonstrates the scalability of Ethereum’s broader network. At one point, Base alone handled more transactions than the entire Ethereum mainnet, and combined, L2s routinely process many times the throughput of L1. Despite that, Ethereum L1 itself has not buckled – its block utilization is around 50%, fees are moderate, and it’s serving its role as final settlement.

What does this mean for a potential altcoin season led by Ethereum? It means the next altcoin frenzy might look and feel different for participants. In 2017, if you tried to buy a hot ICO token, you probably did it on Ethereum L1 and paid high gas fees (or the network lagged). In 2021, trading DeFi tokens or minting NFTs on Ethereum became prohibitively expensive at peak times, pricing out smaller users. In 2025, Layer-2s offer an outlet to handle a surge of transactions without congesting Ethereum mainnet. If millions of new users rush into crypto chasing altcoin gains, they can be onboarded via L2s where they’ll experience low fees and fast confirmations, all while ultimately being secured by Ethereum. This is likely to encourage even more activity, as the usual brake on altcoin manias – e.g. $50 or $100 transaction fees on Ethereum making small trades uneconomical – is far less of an issue now. So an altcoin season in the Layer-2 era could potentially be more intense and involve even higher transaction counts than previous ones, since the capacity is so much greater. It also means that the benefits will accrue back to Ethereum: every trade on Arbitrum or Base still ultimately uses ETH (for paying L2 fees, which eventually consume ETH on L1) and showcases Ethereum’s platform effect.

Layer-2 tokens and ecosystems might themselves become part of the altcoin season story. Many L2 networks launched tokens (Arbitrum’s ARB, Optimism’s OP, etc.) and those could rally if speculation turns their way. So far, the performance of L2 tokens has been somewhat underwhelming – for instance, ARB trades below its initial airdrop price as of August, even though Arbitrum is one of the top rollups by usage. Some traders attribute this to the fact that these tokens are mainly governance tokens (not required for using the network, aside from maybe paying fees in some cases), so their value isn’t directly tied to usage. However, in a euphoric market, fundamentals often take a backseat to narrative. If Ethereum is soaring and people are looking for the “next Ethereum,” they might bid up L2-related projects or DeFi protocols running on L2s, expecting them to catch up. Already, we saw hints of this: when Ethereum’s price blasted past $4,200, optimism spread to smaller-caps and one report noted “smaller-cap altcoins follow ETH’s bullish trajectory”. It cited that Ethereum’s rally was “triggering broader market participation”, implying traders were starting to branch out beyond just ETH.

Moreover, specific success stories on L2s can create mini-seasons of their own. For example, if a certain DeFi application on a Layer-2 becomes the hot thing (much like how Compound or Uniswap kick-started DeFi Summer on Ethereum in 2020), it could drive a lot of new users and capital to that L2. We’ve already seen early examples: the friend.tech social token platform launched on Base in August 2023 brought a surge of transactions and fees to Base. In the current climate, any viral dApp on an L2 can direct attention (and token value) to that layer. This adds another dimension to altcoin season: not only do we consider which coin, but also on which chain the activity is happening. Right now, Ethereum and its Layer-2s form a kind of interconnected megasystem, and collectively they dominate many sectors (DeFi TVL, NFT trading, on-chain stablecoins, etc.). As noted earlier, Ethereum hosts 58% of all tokenized assets across all chains – by far the largest share. So if we indeed get a roaring alt season, much of that could play out on Ethereum mainnet and L2s, reinforcing Ethereum’s position. It’s telling that even after all the growth of rival blockchains in recent years, Ethereum still anchors the majority of on-chain economic activity in categories like stablecoins and real-world asset tokens.

One potential challenge with L2s during a frenzy is bridging and liquidity fragmentation. Users have to move assets between Ethereum L1 and various L2s (and possibly other L1s). In a fast-moving market, bridges can become bottlenecks or points of risk (hacks, delays). However, infrastructure has improved here too, with many fast bridges and decentralized bridge protocols now in place to shuttle funds around quickly. If Ethereum fees do spike at the absolute peak of usage, some chaos could ensue with moving funds, but likely far less severe than in past cycles thanks to advance planning and multiple options (e.g., you can always trade on a different L2 instead of rushing back to L1).

In essence, Layer-2s ensure that an Ethereum-led altcoin season can be bigger and more accessible than ever. They allow the excitement to scale. For average users, this means you might experience the next altcoin boom through networks like Arbitrum or Base without even touching Ethereum mainnet directly – yet Ethereum will still be the underlying security blanket making it all possible. It also means the narrative of Ethereum being the “backbone of future finance” is validated in real time: while Bitcoin sits largely in wallets as digital gold, Ethereum’s network (with its L2 extensions) is bustling with activity, trade, and innovation even at peak times.

From an investment standpoint, one might conclude that if you believe an altcoin season is coming, betting on Ethereum and its ecosystem could be a relatively safer way to capture that upside. This is something even prominent analysts have suggested. Veteran trader Michaël van de Poppe commented that while Ethereum’s rapid rise to $4,200 was a “wild move” and chasing it at those highs carries risk, allocating capital to projects within the ETH ecosystem might deliver better percentage returns if momentum continues. His rationale is that smaller projects related to Ethereum (like certain L2 tokens or DeFi protocols) could see outsized gains once the rally broadens, potentially outpacing even ETH, but they are still tethered to Ethereum’s success. In other words, if you’re bullish on ETH, there are leveraged ways within its orbit to express that – though of course with higher risk.

To summarize, Layer-2 networks stand as critical infrastructure and likely beneficiaries of an Ethereum-led market rally. If Ethereum truly leads a new altcoin season, expect L2 usage to set fresh records as users flock to cheaper platforms to trade and invest. Already, by mid-2025, L2s handle the majority of transactions (85%+) in the Ethereum ecosystem. That trend will only intensify if the pace of speculation picks up. The endgame envisioned by many Ethereum proponents – where the main chain is a secure settlement layer and most activity happens on L2s – is basically happening now. An altcoin season will test just how far this “modular” approach can go in accommodating a tidal wave of demand. All signs so far are encouraging: the network has headroom, fees are low, and upgrades like Dencun have done their job in supercharging capacity. For traders and developers, it’s an exciting prospect: a bull run without the same bottlenecks and pain points as last time.

Of course, no rally is without risks. It’s important to temper excitement with an understanding of what could go wrong or throw the market off course. In the final section, we’ll look at the key risks and uncertainties that could affect Ethereum’s trajectory and the broader altcoin season thesis.

Risks and Challenges: Caution in the Midst of Euphoria

While the current outlook for Ethereum and altcoins is undeniably optimistic, it’s crucial to acknowledge that the crypto market remains highly volatile and laden with risks. History has shown that roaring rallies can reverse suddenly, and new challenges can emerge just when things seem most bullish. Here are some of the key risks and factors to watch as we evaluate whether Ethereum will successfully lead a sustained altcoin season:

-

Overheating and Pullbacks: Rapid price appreciation often sows the seeds of its own correction. As Ethereum hovers near all-time highs, some traders are growing wary of a short-term pullback. Profit-taking by short-term holders is already on the rise according to on-chain data. We saw a glimpse of this when ETH briefly hit $4,600 – shortly after, there was a bout of selling as speculators locked in gains, causing minor dips. Market sentiment indicators also flash warnings; Santiment noted that bullish chatter spiked dramatically as ETH crossed $4k, which can signal overconfidence. In strong uptrends, pauses or corrections are healthy and expected. Even staunch bulls urge caution about “buying at such elevated levels” without a plan. We should remember that after Ethereum’s previous peak in 2021, it suffered multiple 20-30% corrections on the way up and much larger ones in the subsequent bear market. A sudden macro scare or a wave of deleveraging could easily cause ETH to retrace a chunk of its gains in the short run. Such a pullback, if it happened, might temporarily stall any budding altcoin season because a sharp ETH drop would likely shake the entire market.

-

Institutional Overleverage: One of the new risk factors in this cycle, as highlighted by none other than Vitalik Buterin, is the possibility of institutions overextending themselves with Ethereum. The fervor around Ethereum ETFs and corporate treasury accumulation, while positive, can have a dark side if not managed prudently. Vitalik cautioned in August that the trend of corporations buying up ETH for their treasuries and staking yields could turn into an “overleveraged game.” What did he mean by this? Essentially, if companies or funds are borrowing money to buy ETH (leveraging their positions) or if ETF providers are utilizing derivatives extensively to meet demand, it introduces the risk of a cascade. Imagine if ETH’s price fell sharply – those same institutional players might face margin calls or risk controls that force them to sell into a falling market. Jamie Elkaleh echoed this concern, warning that overleveraging by corporate treasuries could destabilize the ecosystem, especially if forced liquidations trigger cascading sell-offs. This scenario is somewhat analogous to past incidents in crypto (for instance, the leveraged unwinding of positions that contributed to 2021’s mid-cycle crash or even the 2022 collapse of players like Terra/Luna, albeit that was more DeFi-centric). While there is no immediate sign of crisis – corporate holdings are still a fraction of ETH supply – it is a risk factor that grows as more big players pile in. The saving grace is that many of these institutional holders claim to be long-term oriented. But sentiment can change quickly if, say, a major ETF sees outflows or a big fund decides to trim exposure.

-

Regulatory and Legal Risks: The regulatory climate has improved, but it’s not without remaining hazards. In the U.S., the SEC has thus far only approved futures-based Ethereum ETFs, not a spot ETF. There is optimism that a spot Ether ETF could eventually get greenlit (especially given Grayscale’s recent legal win for a Bitcoin ETF), but no guarantees. If regulators were to push back or if some negative ruling emerged – for example, classifying certain Ethereum-based yield products as securities – it could chill institutional enthusiasm. Globally, regulations on crypto taxation, exchange licensing, or stablecoins could indirectly impact Ethereum usage. One specific area to watch is stablecoin regulation: Ethereum heavily relies on stablecoins like USDT and USDC as its liquidity engine in DeFi. The GENIUS Act progressing in Congress aims to regulate stablecoin issuance. If mishandled, new rules could affect stablecoin availability, which in turn would affect trading volumes on Ethereum. Additionally, Ethereum’s status as not a security is generally accepted in the U.S. now (the SEC’s focus has moved elsewhere), but were that ever to be challenged, it’d be a huge blow. European and Asian regulators are mostly positive on ETH, but one should keep an eye on any nation that might curtail crypto activity (for instance, if a major economy limited crypto trading, it reduces global liquidity).

-

Macro Economic Shifts: The macroeconomic tailwinds that currently favor crypto could shift direction. Markets are pricing in interest rate cuts and a soft landing for the economy. However, if inflation were to unexpectedly roar back or if the Federal Reserve changes its stance to a more hawkish tone, risk assets like crypto could see renewed pressure. One cannot rule out macro surprises – e.g., an economic slowdown that’s sharper than anticipated or a credit event in traditional markets – that cause investors to reduce exposure to volatile assets. In such scenarios, Bitcoin tends to outperform altcoins (investors retreat to the relative safety of BTC or to cash), which would put a quick end to an altcoin season. So far in 2025, the macro signs are benign, but this is a variable largely outside crypto’s control.

-

Security and Technical Hurdles: Ethereum’s core infrastructure has proven resilient through the Merge and subsequent upgrades, but rapid growth can sometimes reveal technical bottlenecks or vulnerabilities. One example is the risk associated with bridges connecting Layer-2s and other chains. In past years, bridge hacks have led to significant losses. If an altcoin season intensifies and more value flows through multi-chain bridges, they become juicy targets for attackers. A major hack or exploit (whether on a DeFi protocol or a cross-chain bridge) could momentarily spook the market and dent confidence in the ecosystem’s safety. Ethereum itself hasn’t had a catastrophic technical failure in a long time (the last major incident was the DAO hack and chain split in 2016, which gave birth to Ethereum Classic), and it’s battle-tested at this point. But one should always consider tail risks – for instance, what if a critical bug were found in a popular Layer-2’s code, forcing a pause or rollback? Such an event could freeze activity and impact prices. The Ethereum core developers are also planning future upgrades (like the Verge, Purge, etc. in the roadmap); while none seem likely to destabilize things, any complex software rollout carries risk.

-

Market Psychology and Timing: There’s a saying: “By the time everyone calls it altcoin season, it’s almost over.” Markets are forward-looking and often contrarian. If sentiment becomes unanimously convinced that altcoin season is here and will persist, that’s when one must be most cautious. We’ve started to see mainstream financial media pick up on Ethereum’s rally and altcoin chatter. A sudden flood of retail FOMO, while initially boosting prices, could create a blow-off top scenario. Already, some analysts are issuing lofty price targets – for example, Fundstrat’s Tom Lee recently predicted Ethereum could reach $16,000 by year-end 2025 if macro tailwinds hold and derivatives demand persists. Prediction markets give about a 74% probability that Ethereum will hit a new all-time high in 2025. These are optimistic odds. If everyone is positioned for more upside, the market can become fragile to any disappointment. It’s possible the altcoin season, if it fully materializes, might be short and intense, as these periods often are. Timing exits is notoriously hard – many retail investors got caught when the music stopped in previous cycles, holding bags of altcoins that plunged in value.

-

Competition from Other Altcoins and Blockchains: Another angle to consider is that while Ethereum is in focus now, crypto markets have many moving parts. It’s conceivable that another narrative could steal the spotlight from Ethereum if something big happens. For example, if a rival smart contract platform like Solana or Cardano suddenly delivers a breakthrough or an explosive rally (perhaps due to its own upgrade or a specific app going viral there), it could divert capital from Ethereum and muddle the idea of an Ethereum-led altseason. In 2021, we saw mini-seasons like the “Solana Summer” where SOL and its ecosystem boomed independently. Right now, Ethereum has the clear momentum and its L2s cover its scalability, but one shouldn’t dismiss the rest of the field. There are still Bitcoin-centric cycles (like if Bitcoin ETFs get approved, BTC could briefly suck the oxygen again), and specific sectors like AI tokens or metaverse coins could have their own runs not tightly correlated with Ethereum. An altcoin season implies broad participation, but it’s possible not all boats will rise evenly. If Ethereum becomes too dominant, ironically, that might limit the upside of smaller alts (as we discussed in Ethereum season).

In light of these risks, prudent risk management is key even as optimism runs high. The fundamentals for Ethereum look stronger than ever and the ingredients for an altcoin season are largely in place, but external shocks or internal excesses could derail things. Traders and investors are advised to keep an eye on leverage in the system (funding rates, borrow levels), watch for any signs of trend reversals in BTC dominance or ETH momentum, and not overextend on illiquid alt positions that could become hard to exit in a downturn.

Jamie Elkaleh perhaps summed it up well: “All the ingredients for an Ethereum altcoin season are here, but there are no guarantees… risk management remains critical to preserve both value and decentralization.”. It’s a reminder that even as Ethereum becomes a “lightning rod for corporate capital” and retail enthusiasm, one must stay vigilant for potential downsides.

Final thoughts

Ethereum’s powerful resurgence in 2025 – marked by new price highs, booming network activity, and surging institutional interest – has positioned it as the prime contender to lead a new altcoin season. The evidence of a shifting regime in crypto markets is mounting: Bitcoin’s dominance has started to slip from its peak, capital is rotating into Ether, and even long-dormant altcoins are showing flickers of life as investors broaden their horizons. In many ways, what we are witnessing could be dubbed an “Ethereum season.” Ethereum has taken center stage with outsized gains and is currently outperforming most of the crypto field. Its breakout above key levels – climbing past $4,000, then $4,500 – has been the catalyst injecting confidence into the entire altcoin complex.

Yet, the full bloom of an altcoin season, classically defined, requires more than just a strong Ethereum. It requires sustained and broad-based altcoin outperformance versus Bitcoin, a trend that persists over multiple weeks or months. Are we there yet? Not quite, but we appear to be on the cusp. By all accounts, Ethereum’s recent rally is a vital clue and precursor. Jamie Elkaleh emphasized that Ethereum’s surge alongside a dip in BTC dominance toward the high-50% range “points to early capital rotation”, and on-chain signals like record transaction volume and growing Layer-2 usage “add weight to the shift.” Still, Elkaleh rightly notes a true altcoin season will hinge on sustained altcoin outperformance, a rising total altcoin market cap, and persistent new liquidity inflows (such as those driven by ETFs or other investment vehicles). In plainer terms, altcoins need to keep beating Bitcoin over an extended period, and fresh money – not just recycled profits – should be coming into the altcoin space.

At this juncture, many of the ingredients are in place. Ethereum has delivered a stellar fundamental performance: usage is at all-time highs, technological upgrades have increased capacity, and the asset is now firmly on institutional radar with record-setting ETF flows. The narrative around Ethereum has evolved to highlight its critical role in the future of finance, making it an appealing investment story alongside Bitcoin’s digital gold meme. The spillover to other altcoins has begun, albeit measured. We’ve seen how XRP’s legal victory lit a fire under legacy alts, and how decentralized finance platforms and Layer-2 networks are flourishing on the back of Ethereum’s momentum. If Ethereum can maintain its upward trajectory untethered from Bitcoin’s movements – essentially carving out its own leadership role – it would greatly “cement its position over other altcoins” and likely pull the rest of the market up with it.

What happens next? A few scenarios are plausible. In a bullish scenario, Ethereum continues climbing and finally breaks its all-time high, perhaps decisively moving above $5,000. Such a milestone could act as a psychological trigger that unleashes “full risk-on” behavior in the crypto market. Retail FOMO could surge, latecomers might pile into not just ETH but a variety of altcoins, and the classical altseason pattern (large caps then mid caps then small caps pumping) could play out swiftly. Under this scenario, we’d likely see Bitcoin dominance fall further into the 50%-and-below zone, while total altcoin market capitalization (excluding BTC) rises significantly. The presence of Ethereum ETFs and possibly impending Bitcoin spot ETFs might provide continuous liquidity to keep the party going, at least for a while. Layer-2 networks would thrive in this environment, handling the influx of users and trades, and their growth would reinforce Ethereum’s value, creating a positive feedback loop.

In a more neutral scenario, Ethereum might lead a modest altcoin rally but not a euphoric one. It could be that ETH outperforms and reaches a new high, yet the broader altcoin gains remain selective – favoring quality projects or those with clear narratives (like Ethereum’s own ecosystem tokens, AI-related coins, etc.) rather than lifting every coin indiscriminately. This would resemble an “Ethereum season” that blurs into a mild altcoin season, but perhaps without the extreme mania of 2017 or 2021. Bitcoin might hold relatively strong in such a case, keeping dominance in a moderate range. The crypto market could see a rotation of leadership (BTC then ETH then some others) without the kind of blow-off top frenzy that historically marks cycle ends. Some would argue this could even be healthier, albeit less exciting for speculators looking for 100x moves.

And of course, in a bearish scenario, unforeseen events – be it a macro shock or an internal crypto issue – could cut the altcoin rebound short. Ethereum’s rally could stall at resistance (say around previous ATH), and if Bitcoin also retraces, the whole market might cool, delaying any altseason until a later date. It’s worth remembering that in 2019, for instance, Bitcoin had a big run but an altcoin season never fully materialized; BTC dominance in fact rose for a prolonged period. Could that repeat? It seems less likely now given Ethereum’s much stronger position and usage today versus 2019, but nothing is guaranteed.

What about the Layer-2 angle specifically – “what happens to Layer-2 if Ethereum season comes true”? The research suggests that if Ethereum enters a period of high demand (both in price and network activity), Layer-2 solutions will shoulder much of the transactional load, enabling the growth to be more sustainable. We’ve seen that already: as Ethereum usage hit records, L2s handled 85%+ of transactions and kept fees low. If Ethereum season intensifies, we can expect Layer-2 networks to attract even more users, liquidity, and perhaps investment attention (for example, venture funding or token speculation). In practical terms, this means new entrants chasing altcoins might start their journey on a network like Base or Arbitrum without even realizing they’re using Ethereum’s infrastructure – a testament to how seamless scaling has become. The Layer-2 boom also implies that any altcoin season will be more intertwined with Ethereum than ever. Many of the hottest altcoins could be those directly connected to Ethereum’s ecosystem (whether it’s L2 tokens, DeFi tokens, or assets like staked ETH derivatives). The rising tide of Ethereum can lift boats in its harbor first and foremost.

Ultimately, Ethereum’s emergence as a potential leader of the next altcoin season signals the maturing of the crypto market’s second-largest asset. From a speculative “alt” in 2015 with only promises, Ethereum has grown into a multi-faceted platform underpinning huge swaths of the crypto economy. Its ability to attract serious capital and usage gives credence to the idea that an altcoin rally can be led by fundamentals, not just hype. That said, the crypto market never operates on fundamentals alone – human psychology, macro trends, and innovation cycles all play a role. Traders and enthusiasts should stay informed and agile. Keep an eye on key metrics: Bitcoin dominance (is it continuing to dip?), ETH/BTC ratio (is Ether extending gains against Bitcoin?), total value locked in DeFi and L2s (growing healthily or overheating?), and external factors like ETF approvals or interest rate decisions.

In closing, the question “Is Ethereum leading the new altcoin season?” can be answered as follows: Ethereum is certainly making the strongest case we’ve seen in years to be the torchbearer of the next altcoin surge. Its recent performance and the structural support beneath it (institutional buy-in, on-chain strength, scaling solutions) have created conditions very reminiscent of past pre-altseason periods. If the current trends persist, we may indeed witness the coining of a true “Ethereum season” – one where Ethereum not only leads but possibly defines the market cycle for a time. And if Ethereum succeeds, it is likely to pull the rest of the altcoin market up with it into a broader season of gains.

As always, investors should approach this exciting possibility with a mix of optimism and caution. Crypto markets can turn on a dime, but for now the momentum is clearly on Ethereum’s side. Ethereum’s season may well be dawning, and if history is any guide, the altcoins won’t be far behind – just remember that seasons change, and prudent strategy outlasts even the wildest rallies.